Front view woman wearing trucker hat.

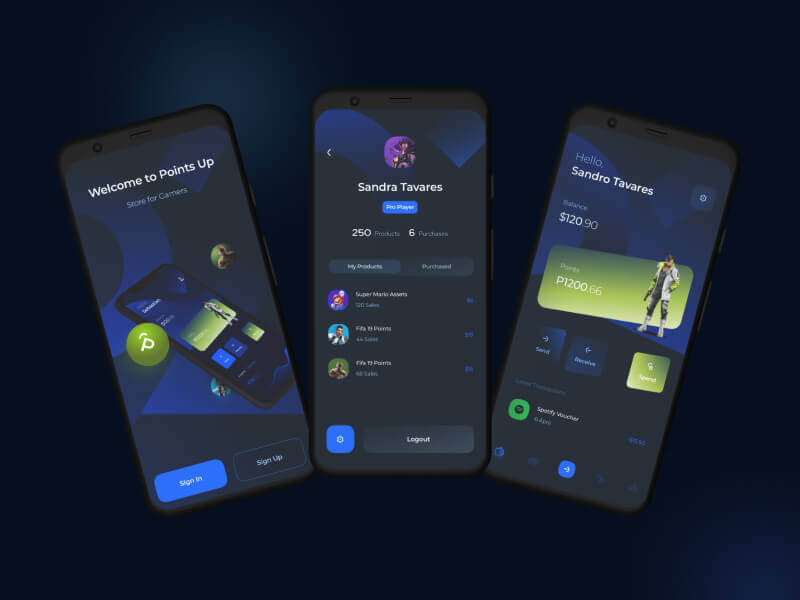

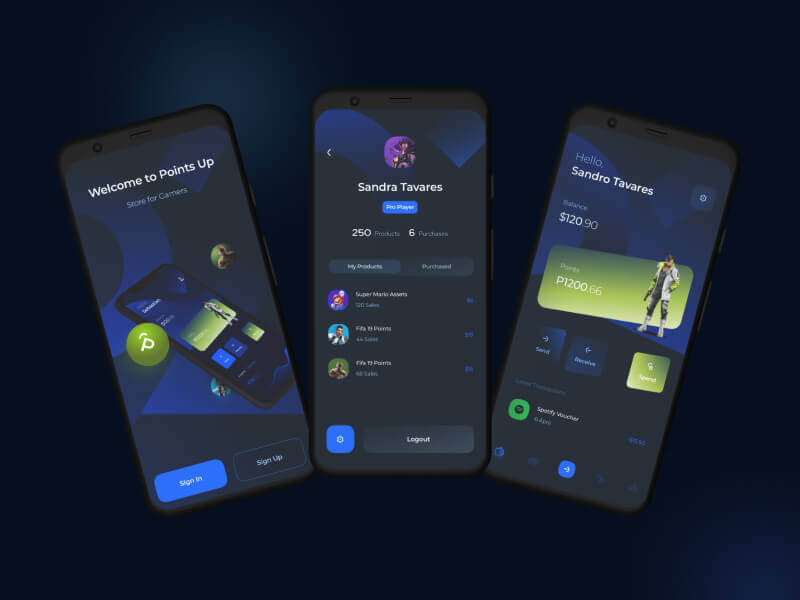

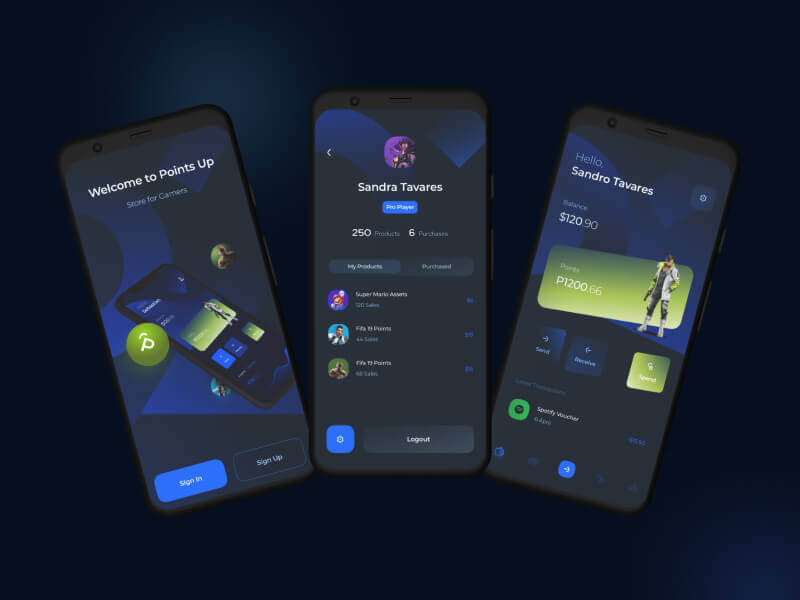

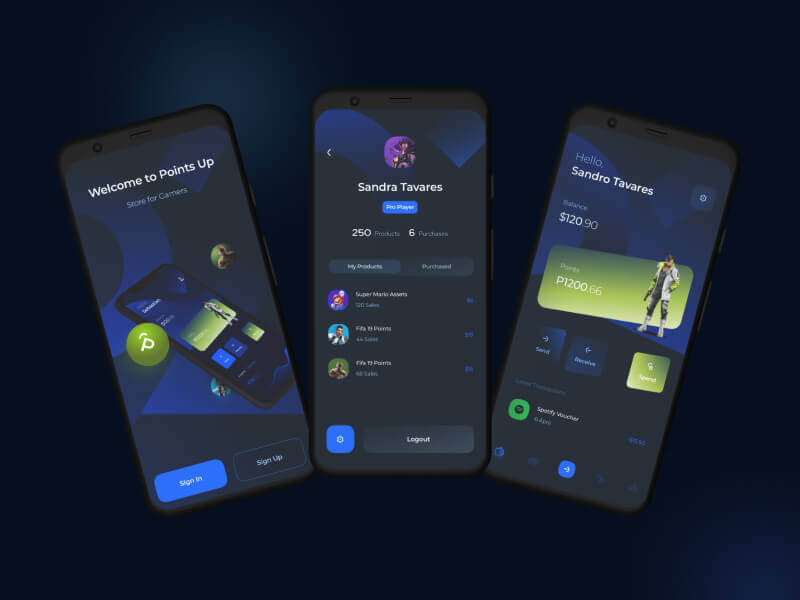

Through a wide variety of mobile applications

- Client Nusrat Nill

- Date 25 June 2021

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Eum in eos saepe ipsa cupiditate accusantium voluptatibus quidem nam, reprehenderit, et necessitatibus adipisci.

Lorem ipsum, dolor sit amet consectetur adipisicing elit. Inventore dolorum atque dicta distinctio mollitia fuga.

Lorem ipsum, dolor sit amet consectetur adipisicing elit. Inventore dolorum atque dicta distinctio mollitia fuga.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

Contrary to popular belief. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

Generate Lorem Ipsum which looks. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

Contrary to popular belief. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

Generate Lorem Ipsum which looks. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

Through a wide variety of mobile applications

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

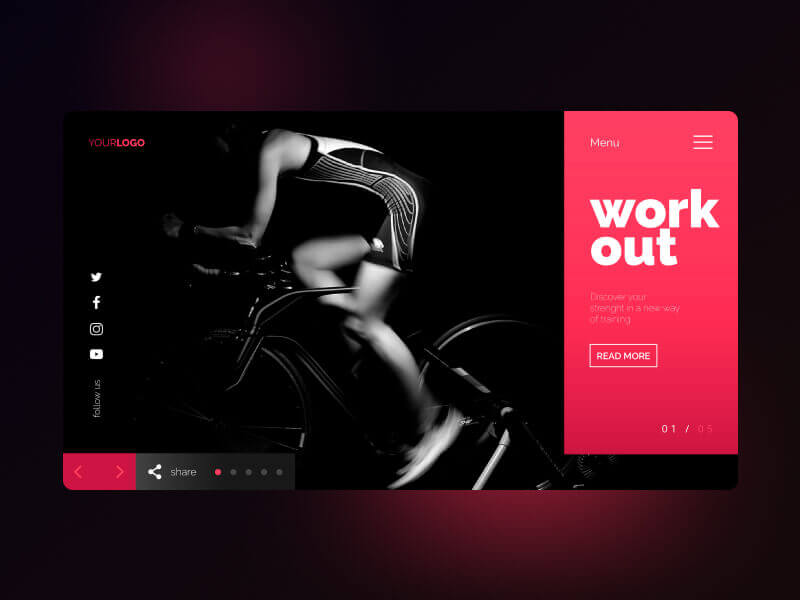

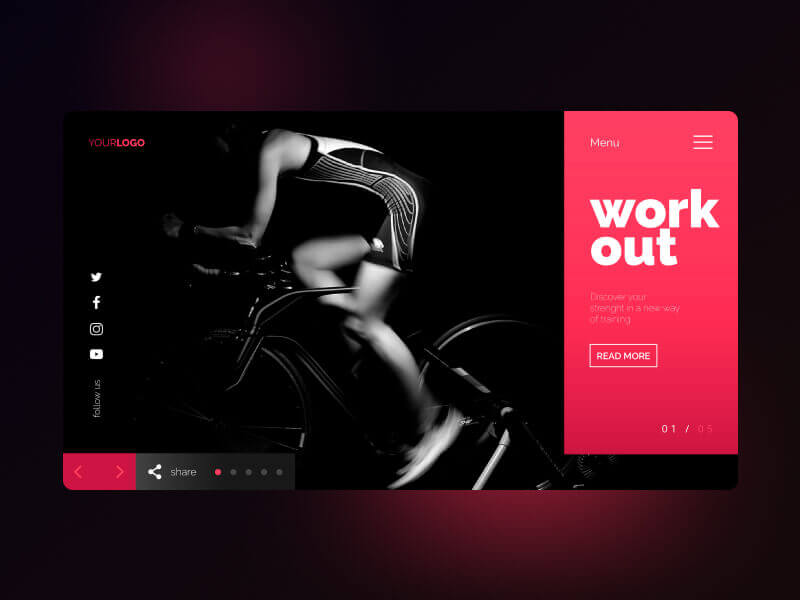

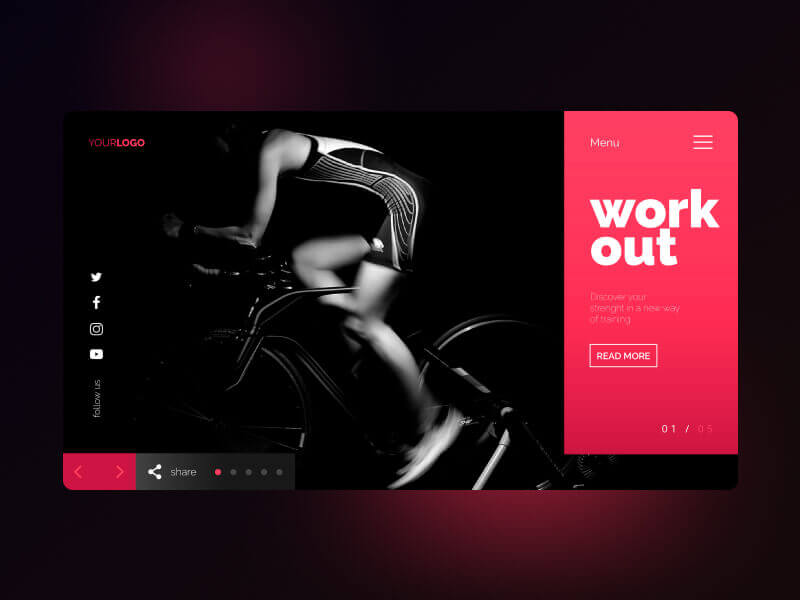

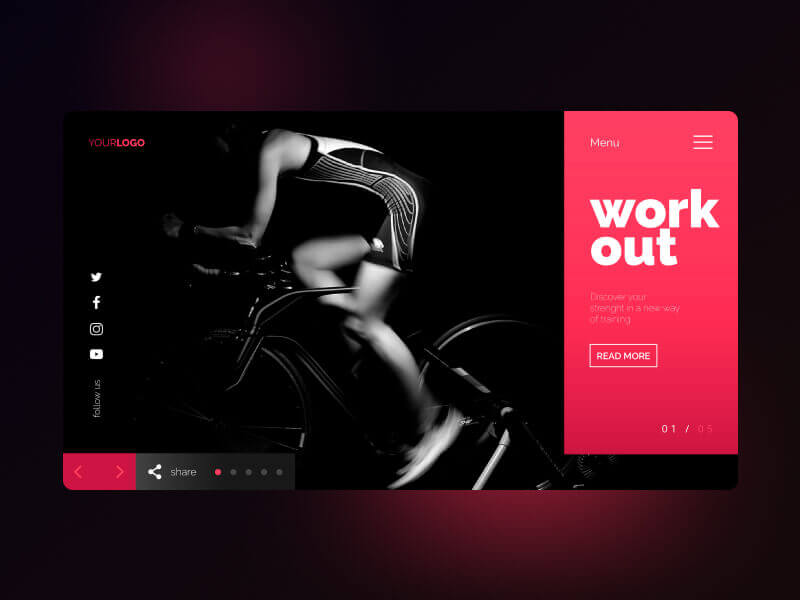

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them.

Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

COVID-19 or Corona Virus making headlines around the world. It’s normal to feel uncertain about many aspects of life right now, including finances.

Let’s take a closer look at how you can keep your finances in order as the COVID-19 situation develops around the world.

Try to Save More

In the current situation, you are staying at home for weeks due to this pandemic. There are chances that you may be losing your regular income during this time if your employer is not offering paid leave or work from home facility is not available. Instead of getting panicked, focus on finding ways to stretch on saving your money. You may be wondering how?

There are few ways of doing so; cutting non-essential spending from your budget. Like, currently you are staying at home, you will be able to save money that you use to spend on transportation and eating outside food. I’m sure your weekend getaways are also locked down currently as you are entertaining yourselves at home through various online media that comes at bare minimum cost. You can consider this money in saving.

Emergency Fund

If your company allowing option of working from home, then consider boosting your emergency fund as you are having your regular income source is still flowing. So, it will be easier to resist the temptation of spending money on impulse buys like online shopping. Take this opportunity to increase your emergency savings (Keep at least 6 months of monthly expenses in Emergency funds).

Stick to Your Investment Plan

Due to COVID-19, there is increased volatility in the stock markets. It is creating anxiousness and in panic, we are tending towards selling our stocks / Equity Mutual Funds during this time of crisis. But believe me, that’s not a good option right now. In fact, choosing to sell your stocks now could result in a realized loss.

I know, it is difficult to watch the value of your portfolio going down and sitting idle of not doing anything to stop it. However, over the period equity markets will recover. Personally, I never planned on touching the money I have invested in the market until retirement. So, I’m not going to change that mindset and stick to the original plan for now. Instead, I plan to hold on for what looks like a wild ride ahead. I fully expect a bumpy ride, but I know that selling stocks for 20 to 30% loss is not the answer. But we can always re-evaluate our investment plan and make any changes if required with the help of Investment / Financial adviser. Important point to note here is don’t stop your SIPs. Instead if possible, increase the amount of SIP.

Take Advantage of Low Interest Rates

As the feeling of uncertainty is around the world, interest rates are dropping as well. If you have a good credit score, then you can likely take advantage of extremely low rates for all kinds of borrowing; especially housing loan.

If you have outstanding debt such as a housing mortgage or education loans, now is the time to refinance. You could potentially save thousands over the course of your loan. Although refinancing can involve quite a bit of paperwork. As you are at home you can easily do this task with comfort.

Benefits of Home loan Moratorium

Drawbacks of Home loan Moratorium

The Bottom Line

We are on edge due to the COVID-19 situation, but that doesn’t mean our finances need to suffer. Act to build your emergency fund before the virus impacts your finances. If your finances are already affected due to COVID-19 situation, take immediate steps to mitigate the long-term financial damage.

STAY HOME, STAY SAFE, STAY INVESTED

DISCLAIMER: Please do your homework and take the help of a qualified Financial Adviser before you take any financial decisions

Is Demonetization Good for Economy ?

The demonetization-driven cash crunch that is playing out in India will create short-term economic pain in the form of the transactional hit created by a hard cash deficit and the structural hit to non-tax paying businesses that would become unviable.

As we move further away from this event, government’s larger crackdown on black money and its resolve to check tax evasion will yield two distinct sets of benefits:

Also, as the informal sector shrinks on the back of a crackdown in the black economy and on the back of the GST implementation, the formal organized sector is likely to gain market share as a ‘formalization effect’ comes into play from the next year onwards.

Trying to describes in greater detail these complex set of effects that demonetization will trigger in the short to long run all are personal view based on various reading and understanding and these level of recall was not done in history so all these could go wrong, I reserve all rights to be wrong

The informal sector accounts for more than 40 percent of India’s GDP and provides employment to close to 80 percent of the labour force. While it is difficult to capture details regarding the profit margins of businesses in the informal sector, it is safe to assume that from the third quarter FY17 to fourth quarter FY19, the share of the informal economy in India could as low as 20%. This shrinkage of the informal sector is likely to result in a short-term adverse effect as the informal sector is no longer able to employ the numbers that it did. However, as the informal sector shrinks, the formal organized sector is likely to gain market share will benefit listed companies. The formal sector accounts for 60 percent of India’s GDP today. Ambit Capital assumes that from FY17 to fourth quarter FY19, the share of the formal economy in India could expand from 60 percent to 80 percent.

Black money will prevent people from parking their savings in physical assets such as gold and real estate. This should boost the flow of savings into the financial system to a significant extent. This in turn should spell a higher influx of flows for financial services providers such as banks, non-banking financial companies (NBFCs)

The most hit will be real estate, land and gold prices in long term, here are some stocks that can benefit in long run, most of them are part of our portfolio already.

| Stock | Current Price | Why it will gain |

| DHFL | 230 | Lot of money will flow it small and mid-segment housing and cost of fund will go down, short term pain |

| NBCC | 225 | This will be the biggest beneficiary, as Govt will build lot of house for poor on Govt land and only PSU in this psace will see lot of orders and can grow order book at 25% CAGR for next 3 years |

| Sun Pharma | 695 | Sun Pharma is trading at very low and it has acquired one more company is Russia and this will help in growth in business |

| ICICI Bank | 255 | It will be biggest beneficiary of Demonetization, low cost of funds and reeducation in Repo Rate on Dec 7 policy |

| Kotak Bank | 750 | Same as Above |

| PFC | 125 | Lot of money was paif by big Defaulters so it will see very good days ahead |

| IL&FS transportation | 90 | This can benefit as Govt will invest into infrastructure and IL&FS will be biggest beneficiary |

| Tata Motor DVR | 290 | It has fallen for multiple reasons like Mistry issue and Demonetization , but in long term there will be very less impact on Land rover and Jaguar sales |

30 % of your income must be used for monthly living expenses

40% of your income must be used for Liabilities repayments (Housing EMI, Loans etc.)

30% of your income must be SAVED and INVESTED for your retirement.

3-5% of your income must be spared for Social cause

6 months expenses must be available for emergency (should be invested in LIQUID FUND or any safe instruments which can be liquidate in a days time

Buying second house for investment is not advisable

After 45 years of age, not supposed to enter into any BIG LIABILITIES (Higher education of children and wedding of children will happen around 45 to 50 only, so plan now for the same.)

Have joint account @ Bank savings account.

Property must be registered on both Husband and wife name. (As per legal act – after husband first legal heir is wife, after wife it will go to children only)

Regular check on Nominations at all financial instruments. if not nominated, do it now..

Only in insurance policy, Claims payable to Nominee. In other financial instruments legal heirs certificate is must to get back the settlement

Must have 10-15 times of coverage in form of term Insurance to financially secure future of your dependents

Don’t take any financial investment decisions EMOTIONALLY, and also Avoid last minute tax saving investment decisions, plan well in advance..

MEDICLAIM is must (in spite of Group mediclaim coverage given at office) (After retirement there is no mediclaim coverage, after 50-55 years of age, it’s very tough and costly to enter into mediclaim)

For your jewelry LOCKER, Only one lakh is payable by bank, if theft or fire happen at bank. Provided insurance done.

Like same way Government guaranteed only one lakh for your FD also. (Fixed deposits with Banks upto Rs. 1 lakh only are backed by deposit insurance)

Must know all Tax implications. You cannot avoid paying tax. But you can minimize by way of tax planning and investments..

All financial documents must be kept safely and keep family members informed of the same..

Financial investments must be followed through personal financial advisory

Review your portfolio at every six month

These are general suggestions, personal Finance and investment decisions depends upon case to case, please consult your financial planner and read disclaimer below

Why I am writing the below article? My mobile was beeping / ringing most of the weekend (3rd and 4th Feb).

Hence I thought let me read a budget fine print and see if I can provide some insights on the questions most asked.

Majority of the calls were stating, there was nothing in this budget for working class and middle class and they sounded very unhappy. L

“Is there was really nothing in the budget for middle-class/salaried-class?” If we look the budget and read headline as ‘I” then yes there is nothing given other than 40000/- Standard deduction and taken out existing 35K benefits + added 1% educational Cess.

But, if I see as an Indian and want better nation then, I personally believe, most of the things were for middle class in indirect form. We, all Middle class Indians, always believe that budget should be in favour of us by reducing taxes, increase income tax slab and so on so forth.

Is this is really true? Partially yes, we need to get something directly, but this time there is lot for middle class in different form. Let us look by few examples.

As mentioned, don’t look at Budget only from “I” perspective. Look it at as an “Indian” and then see does it serve the purpose of nation? Then, I can guarantee you, your dissatisfaction will reduce or you will also appreciate the efforts of Finance Minister, Mr.Arun Jaitley and his team.

Above one are few heavy investments plans in this budget. What I am trying to say, these will create more jobs and it will help the middle class in different forms. We spend avg 2-3 hours on roads, our kids struggle for quality education. Middle class will benefit more by these investments / initiatives.

Direct benefit looks always better, but let the nation or company grow. This time it is not just YOU who get some direct benefit instead a policy introduced that will help the whole nation or company get benefitted through YOU. This govt is working as CEO and CFO so that ‘balance sheet’ is healthy and money is spending properly.

This Budget could have easily said we are increasing Tax slab from 2.5L to 3.0 L which might have brought smiles on our face. But look at bigger picture; we might have not gained anything larger but not lost either. This money will create more jobs as it has been spend on projects. Most importantly, the money is not wasted in the form of “subsidies”. Subsidy has made Indians lazy; instead let all of us work and earn on our own rather than relying on subsidies.

What previous govt has done to get few “votes”, gave away huge amount of subsidies in the form of Farm loan, Petrol, diesel, food and so on. This Govt. instead done proper fiscal maths and invested money on projects that will reduce Below Poverty Line(BPL) population.

Just to bring smile for a day by tax benefits and compromising on Fiscal deficit, might have impacted on Inflation. This would have resulted into giving in one hand and taken out in the form of high prices from other hand (“Ek haat se dena, dusarese lena”). Just to remind, check the inflation rate for the period 2010 to 2012 which was in double digit. Do we really want to go there again for some benefits? I don’t think so.

Lower deficit means safer future from a resultant stable economy. If the government keeps deficit under control we all will get benefit with lower risk.

There were many points/statements raised through our great Media houses to create confusion and headlines like

NO! This is not TRUE, your past gains are NOT taxed. Contrary to a lot of fluff in media , Long term gains prior to Feb 1st 2018 are completely protected and not taxed even if we sell them today or any other day(E.g- If we have bought shares for Rs 100 on Jan 30th 2017 and the value of share is Rs 500 on 31st Jan 2018, then no need to pay tax on profit of Rs 400 (500-100), we will have to pay tax if the sell value is > 500). Only future Long term Capital Gains (Gains earned post Feb 1st 2018 (LTCG)) will be taxed.

Some experts and channel for their selfishness has created hype and investors already lost 6.5 Lakhs crores, by Sensex falling 1000+ points. Very interesting number, 3.67 Lakh crores, LCGT benefit was claimed in year 16-17. Do you know, more than 3Laks crore out of this was actually claimed by big corporate houses and large investors and not the middle class.

If we say ourselves middle class, then our savings should be in range of 6 Lakhs per annum. Even with 15% returns we consider on 6 Laks, which will be 90K and we redeem our units worth of 1 Lakh, profit is exempted from LTCG tax benefit. Even with this, we have 7 Lakhs at hand, so we can manage our annual expenses easily and avoid LTCG with some smart withdrawals (These withdrawls I am talking in retirement period and not when you are saving. As of today, a retiree can manage family with 7 Lakhs per annum easily; this amount will increase if our fiscal maths remains under control).

So, it is our choice between paying direct taxes or pay indirectly with various leakages / other overheads like interests, weak currency which will translate into higher inflation.

I always welcome your valuable feedback/comments. Thank You!

Friends, we generally spend ₹50/- on Tea & Cigar daily. I am not saying you stop smoking or drinking tea, just reserve additional ₹50/- a day and you cannot believe, it will convert to whooping One Crore in 30 years of time.

We all know equity markets in the short run may not give you ‘assured returns’, however, if you give it time, the short-term volatility outbursts can be digested and a certain amount of return can be expected.

At Retireby49, we were keen to find out the reasons why people still hesitate to invest in the equity markets. Recent days I have met so many investors and started checking what really bothered them and the fact was, a vast majority of Indian families are still hesitant to accept equities as a source of serious long-term investment.

This is despite the fact that the Indian equity markets have generated the best returns compared to any asset class over a rolling period of 10-years window.

In our quest to gain an insight into the people’s mental framework, especially while making investment decisions, we decided to find out the reasons behind this mentality.

After talking with people, we have arranged the results to find out the top four reasons that prevent people from participating in equity markets, and they are:

Here are some of our thoughts with respect to the above four points.

Expecting an assured return from the market is as good as expecting Virat Kohli to smash continuous fours & sixes in a test match. We know Virat would not smash fours & sixes, but rather focus on holding the fort and performing steadily as it is test match and not 20-20 match.

Likewise, markets in the short run may not give you ‘assured returns’, however, if you give it time, the short-term volatility outbursts can be digested and a certain amount of return can be ‘expected’.

In fact, you can convert the short-term market volatility into highly profitable opportunities if we stay in market for more than 10 years.

Lack of knowledge is understandable and it is easily solvable. If one wants to invest today and reap its benefits tomorrow, one has to do a bit of work today and also Indian government and SEBI has given various avenues to invest in equity markets like in the form of Equity based Mutual Funds.

Thanks to the internet, there is abundant information available online that will give you sufficient knowledge to get started. You may not believe just 2 -4 Hours a year is sufficient to identify quality equity diversified funds to invest or take help of good Financial planner for first time and then slowly you can invest on your own (Please make sure you are not getting into trap of Agent, identify advisor and not an agent)

Lastly, the argument of not having enough corpus/funds is perhaps the biggest mistake people do.

A young 24-year person has just started earning. His take home salary is ₹20k to ₹22k per month. He is a lavish spender and spends all the money he earns. Looking at his lifestyle a good friend of him advices him to save some money for the future.

Not wanting to save much, reluctantly he decides to set aside just ₹50/- per day for his future needs. Further, considering his good friend’s advice, he decides to save ₹50/- every day for the next 30 years.

He decided that the money is best invested in an equity mutual fund since historically a good equity mutual fund has generated a CAGR return of close to 15% (Returns will vary from fund to fund).

Now here is my question to you – Can you take a guess how much ₹50/- invested at 15% CAGR could grow at the end of 30 years?

In fact, I asked this question to our participants they made a simple calculation which goes like this –

“The guy saves ₹50/- per day or ₹1500/- per month. He invests for the next 30 years, which means he invests close to ₹540, 000/- i.e. ₹1500 per month x 12 months x 30 years. After considering the 15% returns most of them simply declared “At the most his money would have grown to ₹20 – 25 lakhs max and definitely not more than that.”

I asked why you think it would ₹20 lakhs, they said if we invest ₹150,000/- a year in PPF it gives us just ₹40 lakhs, hence ₹5.4 Lakhs should not give more than 4 times of amount invested as returns and investment period is close to double.

The reason I asked this question to my colleagues was to observe how they would treat the 15% CAGR. They easily missed the point that the money is ‘compounding’ at the rate of 15% (~8 % returns in PPF is Doubled in 15 years doesn’t mean it will be 4 times because it is 30 years and 15%).

If you are wondering how much ₹50/- per day would grow when invested at 15% for the next 30 years, then hold on your breath – it would grow to a whopping ₹10,514,731/- (i.e. ₹1.05 Cr)!

Can you imagine that? At just ₹50/- per day, which by the way, is less than a cigar and tea with friends we spend every day can create wealth close to ₹1.05 Crore! How easy is that? This is what is compounding does to your money, it starts growing beyond your imagination!

So dear friends, you have to believe in the power of compounding and start investing today, no matter how big or small the amount is. There are many of you who can afford to save more than ₹50/- per day, so I would suggest you take the plunge towards long-term wealth creation today. After all, investing is not just good for you but for people dependent on you.

I know, now many of you are thinking numbers are looking good but are there really any such products? Just search on internet “equity mutual funds with returns of > 15% in last 20 years”, I can challenge, you will get minimum 10 fund names that gives > 15% returns.

Let me show you another dream as you were able to find 15% is possible if these returns are 18% then the same savings would be ₹2.1 Crore 😊. (Personal Disclaimer – I am personally clocking 18% CAGR from last 13 years by just investing in good quality equity mutual funds)

Good luck and happy investing!

If you like this article and want to avail our services on financial planning, do visit “our Services section of www.retireby49.com. You can also follow us on

Feel free to contact us on +91 93710 89359 or retireby49@gmail.com.

Disclaimer: The author is founder of retireby49.com The views and investment tips expressed in this article are of his own and not that of the website or its management. Please talk to professional Financial Planner / Advisor who can help in better financial planning.

While sitting idle over the weekend with family, my wife said “bore ho raha hai…kuch kam chahiye dimag ko” and one thought came up in my mind. Why don’t we invest ~ 1/2 hour time to create simple strategy for coming week and decide investment strategy!!

I have already been working on some strategies since 3 months post my retirement that can be used in investing in stock markets. So, I came up with new strategy that can be build over weekend by investing 30 minutes and spend 5 minutes on working days to buy & sell them.

The strategy uses a systematic, non-emotional and simple investing approach using stock strength momentum to help you run your investment portfolio successfully on Indian equity stocks by investing just 30 minutes on weekend.

The thought behind the strategy was the approach should be so simple that a person with no background of equity markets should be able to understand the concept and can identify winning stocks on their own without any hurdle.

I have decided to finalize one of the strategy that I use for my stock selection. So, first I have finalized a list of 100 stocks for screening on every weekend (anytime after Friday 5PM and before Monday Moring 9AM) on which this strategy can be applied.

Next decision was the focus on creating a strategy that should work for those who want to generate regular monthly income or if someone has long time horizon, then also it should help them in creating long term wealth.

The participants have to simply follow the strategy and create a portfolio in their own account. This approach ensures regular income along with wealth creation for you. One needs to devote precisely 30 minutes a week to their portfolio and stock screening every weekend. This portfolio will complement well with your other investments if any in Equity or PMS investments you have and help in monitoring them as well.

Due to the tactical allocation model, the system keeps you safe by shifting money to debt during times of deep distress or you don’t find any buying options with the above strategy (Which is very rare).

Below is graph of Infosys for which system provided Entry point. Our weekend strategy has given a buy call on Dec 17, 2017 around Rs. 1000/-, on 27th Mar it is trading around 1160/- almost 16% returns in 3 months. Most important point to note is during this period market given minus 3 % returns.

Holding period can be as short as one week or it can go as long as 12 months. Stop loss may not hit for one year. But you can exit as per your strategy / need. If it is for long term, continue to hold till stop loss is not hit otherwise book partial profits to generate regular income.

After developing this simple strategy, we thought we will run this with few participants who don’t even understand what is stock market or equity and they have not heard of equities in the past.

Apart from my wife, during summer vacation (CBSE short summer vacation In March), I have explained this to my niece and sister in law. My Niece who is in her teen age was able to understand and trade couple of stocks in last 3 weeks and earned ~3K with very short capital under her mother’s guidance.

Then we have decided to back test this strategy. We have back tested most of the stocks from the 100 stocks we have identified. We have back tested the stocks for last 8 years and it has given average ~24% annualized returns. At the same time this strategy was profitable and generated positive returns on more than 70% trades, if we have followed system without fail.

Below is back tested entry and exit for Maruti Udyog stock, for last 6 years, it has given 300% returnsIf anyone want to earn regular returns / build long term portfolio can use this strategy and we will be happy to help them.

Please feel free to contact us on retireby49@gmail.com or +91 93710 89359.

You can also follow us on

I am available for freelance work. Connect with me via and call in to my account.

Phone: +01234567890 Email: admin@example.com