NFT Dashboard Application Development.

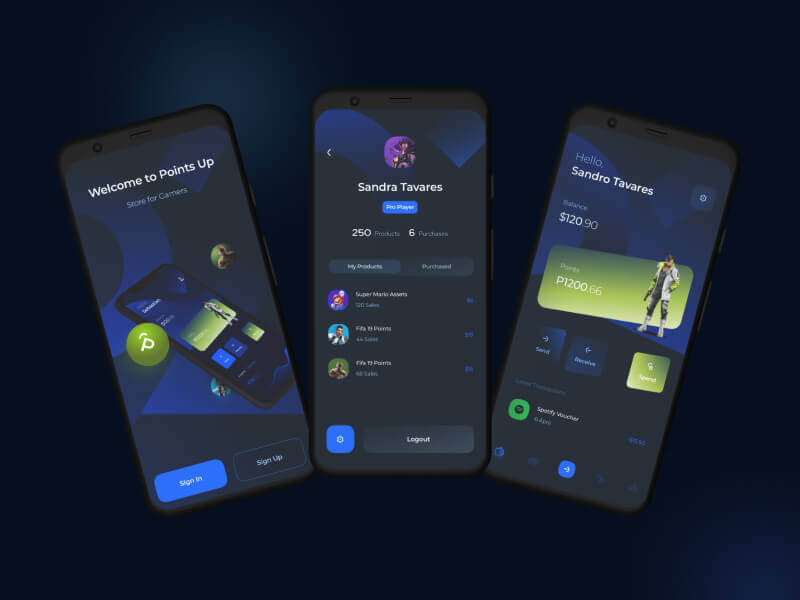

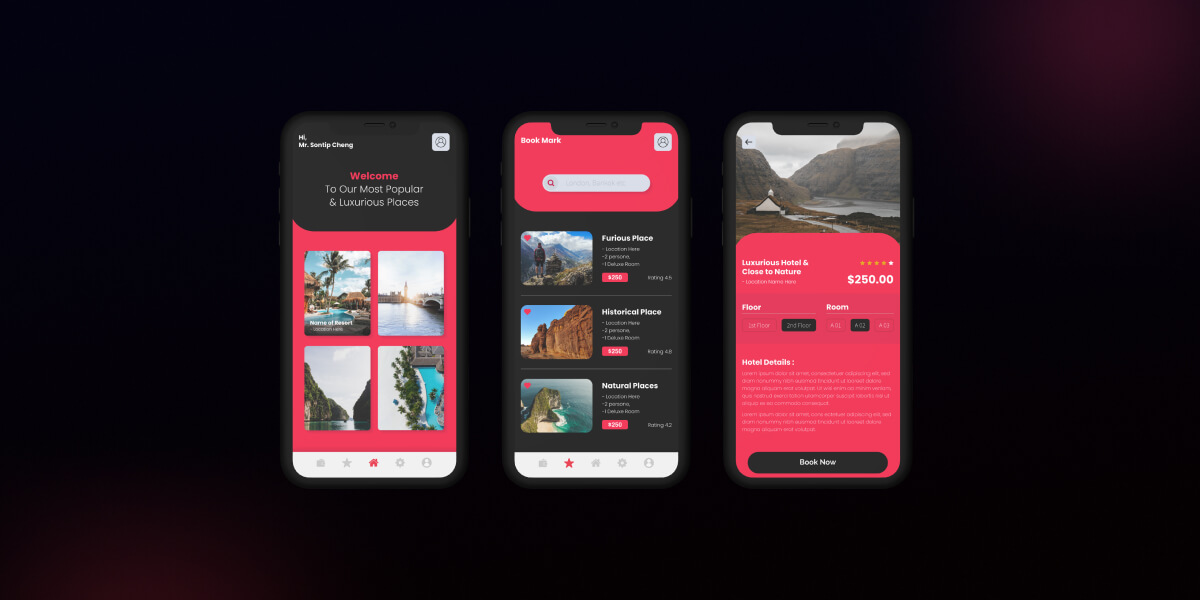

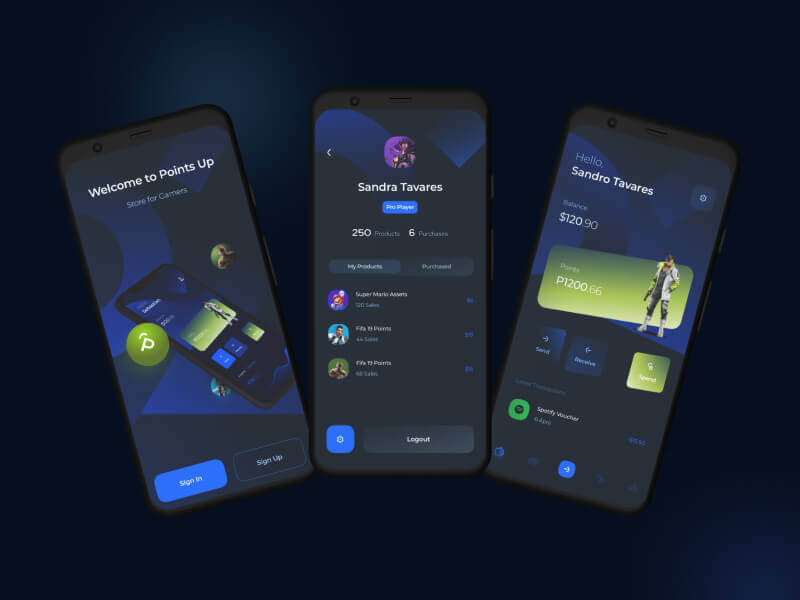

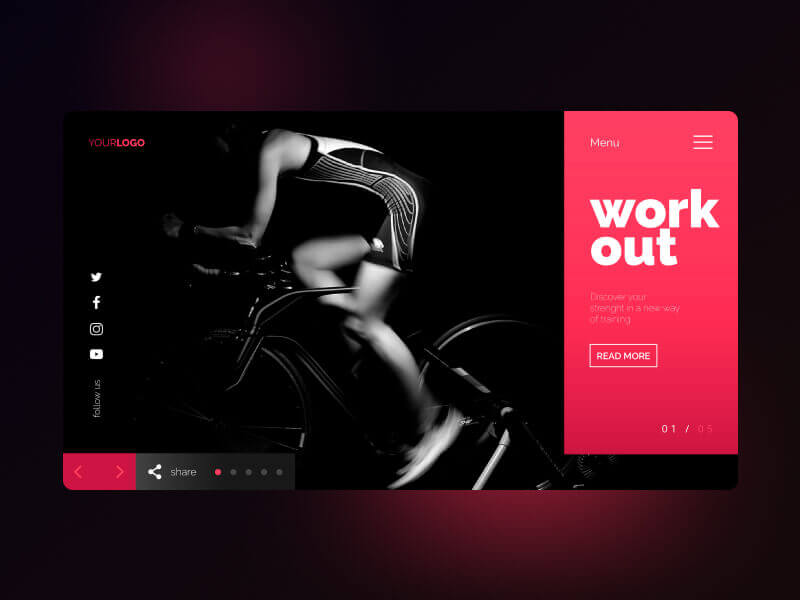

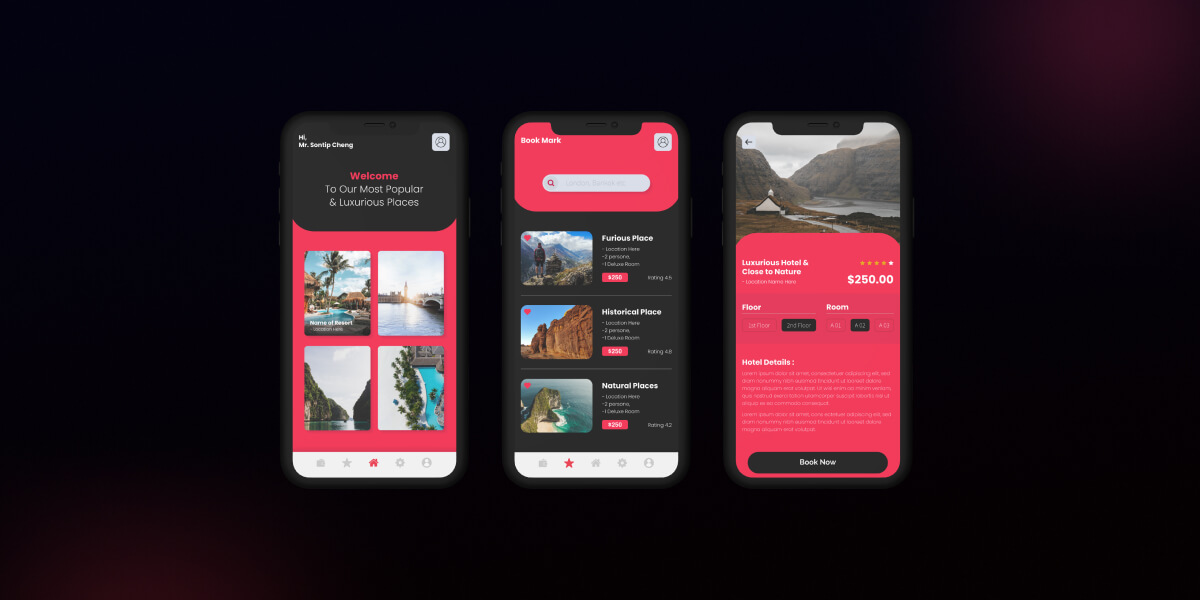

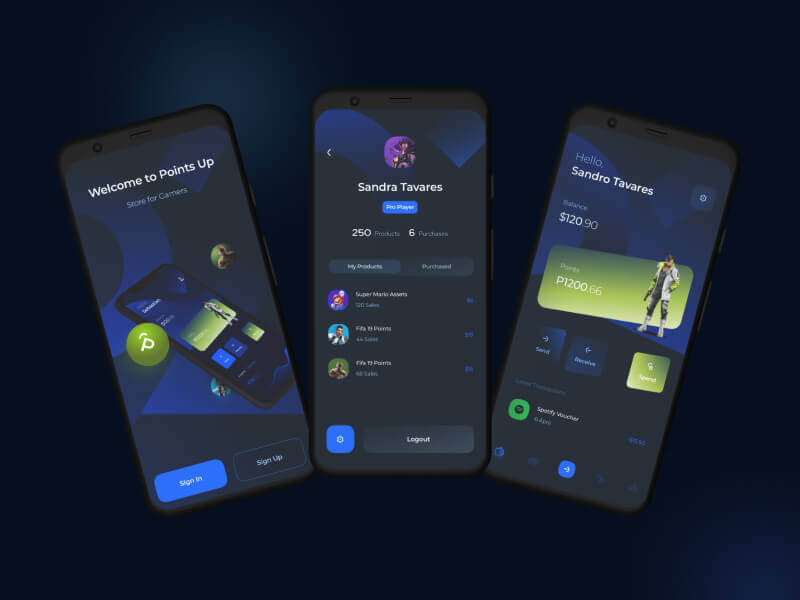

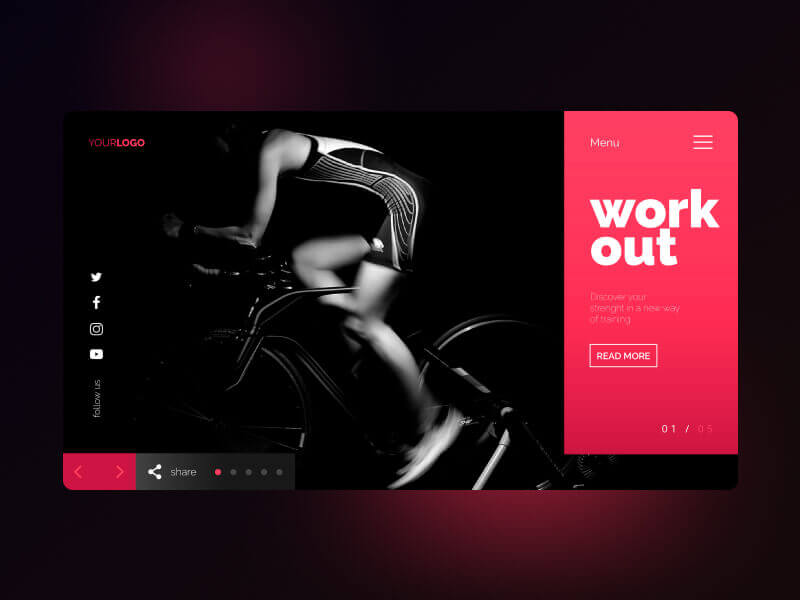

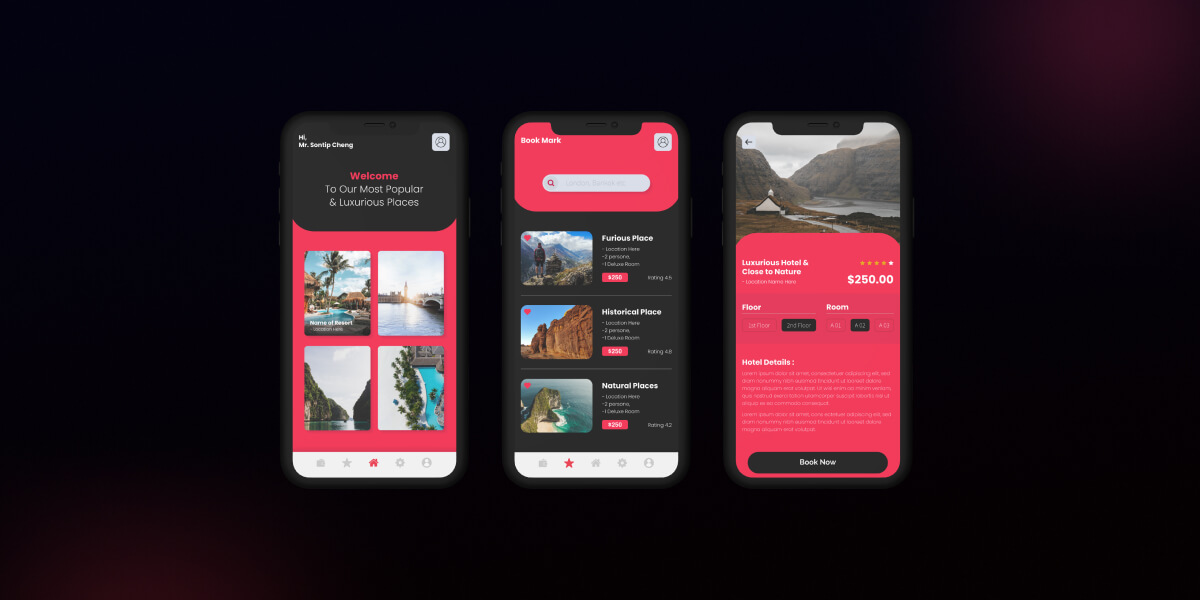

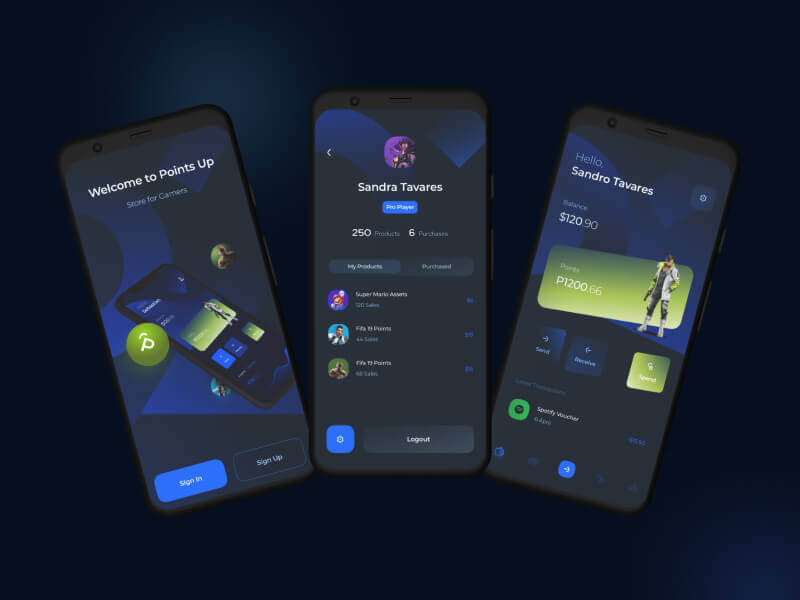

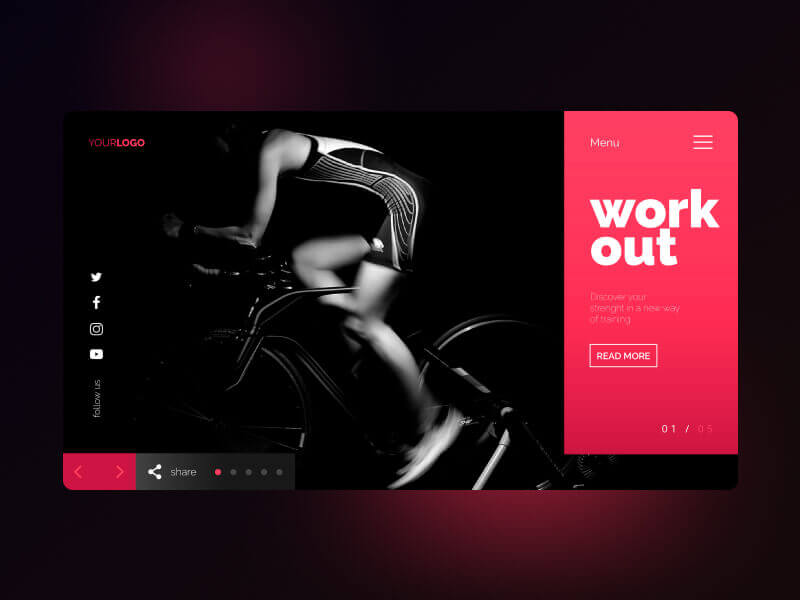

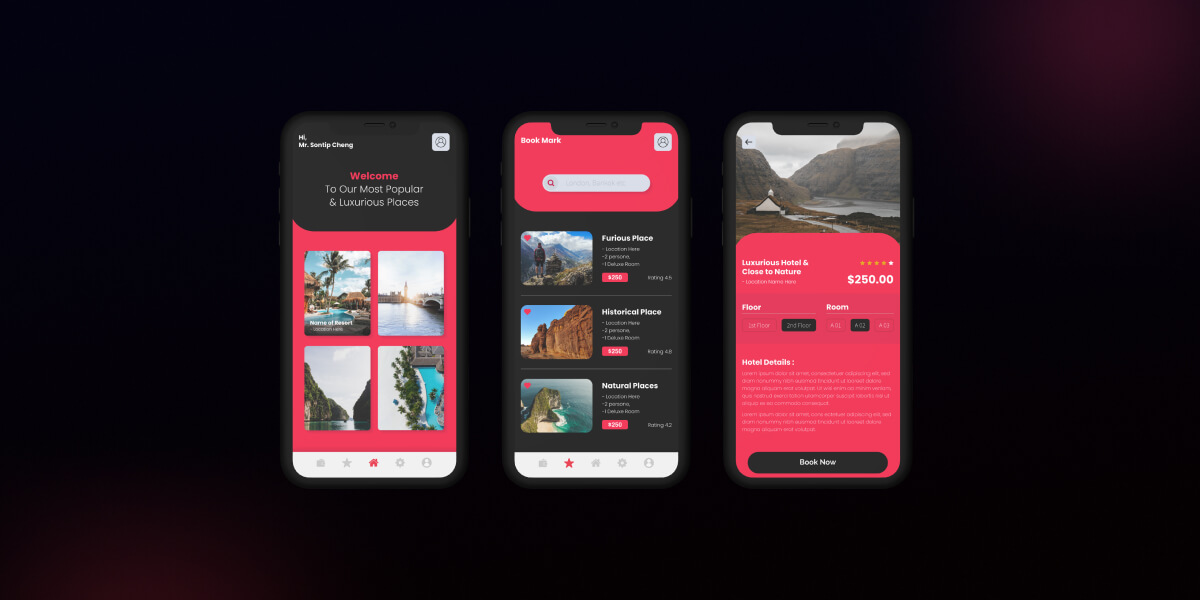

Through a wide variety of mobile applications, we’ve developed a unique visual system.

- Client George Wallace

- Date 15 June 2022

- Services Web Application

- Budget $100000+

I use animation as a third dimension by which to simplify experiences and kuiding thro each and every interaction. I’m not adding motion just to spruce things up, but doing it in ways that.

Qualitative Research, Quantitative Research, Heuristic Evaluation, Competitor Analysis, Usability Testing

We make tailor-made user acquisition to increase business growth for you to uncover all the potential opportunities!

Through a wide variety of mobile applications, we’ve developed a unique visual system.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

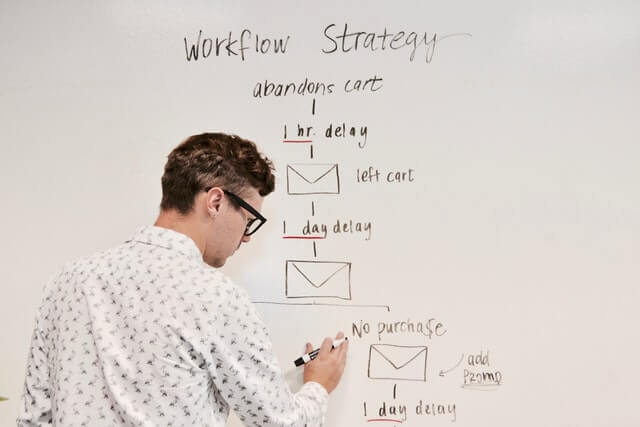

A strategy is a general plan to achieve one or more long-term. labore et dolore magna aliqua.

UI/UX Design, Art Direction, A design is a plan or specification for art. which illusively scale lofty heights.

User experience (UX) design is the process design teams use to create products that provide.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications.

UI/UX Design, Art Direction, A design is a plan or specification for art viverra maecenas accumsan.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

Through a wide variety of mobile applications, we’ve developed a unique visual system and strategy that can be applied across the spectrum of available applications.

A strategy is a general plan to achieve one or more long-term.

UI/UX Design, Art Direction, A design is a plan or specification for art.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Quis ipsum suspendisse ultrices gravida. Risus commod viverra maecenas accumsan lacus vel facilisis. ut labore et dolore magna aliqua.

There are always some stocks, which illusively scale lofty heights in a given time period. However, the good show doesn’t last for these overblown toxic stocks as their current price is not justified by their fundamental strength.

Toxic companies are usually characterized by huge debt loads and are vulnerable to external shocks. Accurately identifying such bloated stocks and getting rid of them at the right time can protect your portfolio.

Overpricing of these toxic stocks can be attributed to either an irrational enthusiasm surrounding them or some serious fundamental drawbacks. If you own such bubble stocks for an inordinate period of time, you are bound to see a massive erosion of wealth.

However, if you can precisely spot such toxic stocks, you may gain by resorting to an investing strategy called short selling. This strategy allows one to sell a stock first and then buy it when the price falls.

While short selling excels in bear markets, it typically loses money in bull markets.

So, just like identifying stocks with growth potential, pinpointing toxic stocks and offloading them at the right time is crucial to guard one’s portfolio from big losses or make profits by short selling them. Heska Corporation HSKA, Tandem Diabetes Care, Inc. TNDM, Credit Suisse Group CS,Zalando SE ZLNDY and Las Vegas Sands LVS are a few such toxic stocks.Screening Criteria

Here is a winning strategy that will help you to identify overhyped toxic stocks:

Most recent Debt/Equity Ratio greater than the median industry average: High debt/equity ratio implies high leverage. High leverage indicates a huge level of repayment that the company has to make in connection with the debt amount.

The training provided by universities in order to prepare people to work in various sectors of the economy or areas of culture.

Higher education is tertiary education leading to award of an academic degree. Higher education, also called post-secondary education.

Secondary education or post-primary education covers two phases on the International Standard Classification of Education scale.

Google’s hiring process is an important part of our culture. Googlers care deeply about their teams and the people who make them up.

A popular destination with a growing number of highly qualified homegrown graduates, it's true that securing a role in Malaysia isn't easy.

The India economy has grown strongly over recent years, having transformed itself from a producer and innovation-based economy.

Google’s hiring process is an important part of our culture. Googlers care deeply about their teams and the people who make them up.

A popular destination with a growing number of highly qualified homegrown graduates, it's true that securing a role in Malaysia isn't easy.

The India economy has grown strongly over recent years, having transformed itself from a producer and innovation-based economy.

The training provided by universities in order to prepare people to work in various sectors of the economy or areas of culture.

Higher education is tertiary education leading to award of an academic degree. Higher education, also called post-secondary education.

Secondary education or post-primary education covers two phases on the International Standard Classification of Education scale.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

The education should be very interactual. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante.

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris test

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris

Maecenas finibus nec sem ut imperdiet. Ut tincidunt est ac dolor aliquam sodales. Phasellus sed mauris hendrerit, laoreet sem in, lobortis mauris hendrerit ante. Ut tincidunt est ac dolor aliquam sodales phasellus smauris

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

1 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

2 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

8 Plugins/Extensions

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

1 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

2 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

8 Plugins/Extensions

All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary

1 Page with Elementor

Design Customization

Responsive Design

Content Upload

Design Customization

2 Plugins/Extensions

Multipage Elementor

Design Figma

MAintaine Design

Content Upload

Design With XD

8 Plugins/Extensions

Let me start with simple principle we have always been taught since childhood. We should take proper diet regularly and timely that will provide us energy to work more effectively. But, when it is about savings, we always see common practice in many families is to spend our money first and invest with leftover amount. Is this the right analogy? May be not. We make sure we do 30-45 Minutes of regular exercise that keeps us fit. In the same way we should invest first and then spend what is left. This article is little long. I request you to read till end so it will make sense and help you in retiring early and fulfilling your Crorepati (Millionaire) dream.

What should be your mathematical equation to achieve your Crorepati dream. It is so simple!! “Income – Savings = Expense”.

I’m a Husband, Parent, Brother and I have gone through this rigor. My aim in this article is to help you get started and point you towards the right direction of savings and wealth creation for your family to fulfill above roles.

As a parent, it is quite natural if you have had those sleepless nights worrying about savings for your child to provide better education, secure life, quality living and avoid all the struggles you had when you were young.

The next question pops up, how much money is required by the time my child turns 18 for his higher education? How to generate so much money? How much to save, where to save and a chain of other related questions and worry how to accumulate such a huge money.

This seems as daunting as this may seen. Trust me; saving money efficiently depends upon disciple about regular investment. “Let us deal with discipline part first”.

If you think about ‘savings’ in terms of a mathematical expression, how will it look like?

Most likely you would say [Income – Expense = Savings].

Like many others, if you too think the above equation makes sense, then I’m afraid you’ve got it all wrong. If we go by the above equation, then we are essentially prioritizing expenditure over savings.

Agreed, expenditure over daily essentials is necessary, but many end-up spending a significant amount of money over lifestyle habits. Think about all the times you have bought that overpriced phone, or a fancy handbag, or camera, or sunglasses.

Each month the desire to own or experience something new and fancy slowly creeps in and we succumb. There is no harm doing this, after all, you are spending your own hard earned money.

The problem however is, it eats your ‘savings’ portion. This further leads to two serious problems –

So, how do we deal with this? Quite simple, we just need to rearrange the above equation

[Income – Savings = Expense]

The above rearranged equation appears very straightforward, but you will come to know the huge difference it makes by end of this article. By rearranging, we are essentially prioritizing savings over spending.

This literally means, the moment we draw our salary, first divert the funds towards savings and then spend whatever is left. This makes very big deal.

Adopting this approach is a way of life and requires a great amount of sacrifice and discipline, because you will have to live by the rules of this equation month on month, for many years. This, by no means, is an easy task. This implies that you cannot go out and pick up a fancy phone just because it looks fashionable in your hands. You are now forced to sacrifice this instant gratification for a bigger benefit which you would enjoy many years later.

The second important aspect is time. The sooner you start saving, the better it is for you and your family. In fact, I am always grateful who has advised me and I followed them and when I look back today, you cannot believe I am happily retired at age of 43. Yes, you read it right, I’m happily retired at 43.

What difference this makes, you may ask. Well, it makes a massive difference. Let me tell you a small story to help you understand the massive impact of time on savings.

A father gives his three young sons a lifelong pocket money of Rs.50,000/- each, every year. They are free to use this money in the way they decide. They are also given an option to invest this money in any legal instrument but with a condition that the investment made should not be touched till their 65th birthday.

Here is what each one does with their money –

● The elder one decides to save money very early in life. He started saving from his 20th birthday till 30th birthday (10 Years). He saved a total of Rs.5,00,000/-. After making his savings for 10 years, he enjoyed the remaining cash flow for the rest of life.

● The 2nd son enjoyed the cash flow first, but on his 28th birthday, he decides that he too needs to save the same amount as his elder Brother did. He saved money till his 40th birthday. The total savings was of Rs.6,00,000/-.

● The younger one also started saving his money from his 35th birthday onwards (After kids are grown up 4 and 6-year-old), but he decides to save all the money he receives until he turns 65. His total savings amounts to Rs.15,00,000/-

As mentioned earlier, investments grow at ‘very moderate’ rate of 12% year on year. Now, here is a question for you – can you take a guess on how much each person’s investment would grow to on their respective 65th birthday?

This may surprise you – how important role “power of compounding” has in our investments

● Elder son’s investment of Rs 5,00,000 grows to a whopping Rs > 5 crore.

● 2nd son who saved 6 Lakhs amount, his investment grows only to Rs 2.20 crore.

● The younger saved lot of money but he still cannot achieve what his both elder brothers achieved with their investments. His investment grows only to Rs 1.50 crore even though he saved more than his both brothers saved (11 Lakh vs 15 Lakhs).

Interesting right? Starting early in life makes a huge difference, so much so that the younger son’s massive investment of Rs. 15 lakhs (made over his lifetime) still cannot beat the elder one’s meagre investment of Rs. 5 lakhs made early on in life. As you may have realized, “Time” is making all the difference here. This is the “Power of Compounding”!

I’ve not been smart enough to make savings when I was 20 years old and I’m guessing not many who are reading this article would not have did this either. Given this, what do you think is our best option now?

Well, here is a bitter pill – we have to do what the younger son did if you are in Late 30s or go as per second son’s plan, if you are in early 30’s. As, we have not good as elder one’s investment strategy (you are lucky if you are in early 20’s then follow elder son’s principal), we need to increase our investment tenure and amount for more number of years.

To generate a significant amount of wealth for our families, we have to start saving continuously. I know these sounds like a long and boring plan, but well, there are no alternatives!

But here is a twist – the only thing that can compensate for lost time is higher ‘Rate of Return’. The higher rate of return can significantly compensate for the lost time. So, essentially, we should look at investing continuously in instruments which can yield a higher rate of return.

This leads us to the million-dollar question – where should we invest?

Before we get into that, let me tell you what most parents do in their pursuit of ‘saving for the child’. This, frankly, in my opinion, is a financial sin, please do not commit it.

Insurance/Insurance-linked ‘child’ plans

Run away from agents who try to peddle these insurance-linked savings plan for your child. Insurance is an expense and it cannot double up as an investment, whichever way you look at it.

Typically, these plans come with an annuity component, wherein a series of cash flow is expected when your child hits a certain age. The annuity component makes young, financially innocent, parents believe that the future cash flow would come handy when the child starts higher education.

However, if you break down the numbers you will realize that the rate of return on these instruments is mediocre, sub 6% in most of the cases. There are two serious problems with such ‘investments’; you not only commit large amounts of money every year (for many years) towards such low yielding avenues, but you also lose out on many attractive investment opportunities which can otherwise generate great returns.

Please avoid this and liberate yourself from such long, pointless financial commitment.

Savings Bank

Many parents open a bank account in the child’s name and start hoarding cash in the account. Cash in savings account creates an illusion of safety. In reality, money in a savings account is the probably the worst form of investment. Inflation is real and inflation will eventually vaporize your money’s purchasing power, and you won’t even realize this.

As you may know savings bank account yields are in range of 3.5 to 4% , the average inflation rate is about 5 to 6%, this means you are losing about 2% by parking your money idle in a savings bank account. A futile venture if you ask me.

So, what are the other investment options at your disposal? How should parents build a portfolio for their child? Well, here is what you can look at doing.

1. Equity-oriented Mutual Funds (50% to 60%)

I understand that many people find it scary to invest in a Mutual Fund. The usual thought is that mutual funds invest in stocks, and stocks are volatile therefore it is easy for one to lose money.

Yes, they are volatile and that is the nature of the beast. Imagine, if you had an option to see the valuation of your apartment on a daily basis. Naturally, the price of your apartment would vary (1Cr today, 95L tomorrow, 1.05Cr day after) – would you consider this volatile? May be not, as we believe real estate is the safest bet over the long term.

Likewise, investing in equities requires you to change your mindset. Stocks are volatile and the only antidote to volatility is time. If you give your mutual fund investment adequate time (which you should) then you can expect a great rate of return.

Historically, average returns of mutual funds over a 15 year period (in India) have been in excess of 14 to 15%, which as you can imagine is brilliant. Of course, there are funds which have delivered over 20% as well.

I’d strongly suggest you save up to 60% of your investable cash flow toward equity oriented mutual fund, via the SIP route. Most importantly, you need to give this investment time, at least 8 to 10 years in my opinion (Also let me give you simple formula to decide how much you should invest in Equity, if your age is 35, then 100-35 = 65, 65% should be in Equity and 35% in debt).

2. Fixed Income (30%)

By Fixed income, I’m not talking about the regular bank fixed deposits. You should explore options beyond this and venture into AAA rated corporate bonds. Some of the AAA bonds give you over 10% interest, which I think is great for a fixed income return.

Besides, an AAA rated bond implies there is a great amount of capital safety. Keep an eye out for these corporate bonds and consider investments in these instruments.

3. Gold (6-8%)

Don’t expect gold to deliver spectacular returns over the years. At best you can expect an average of about 6-8%. But you need this investment as a hedge against inflation. Gold to a large extent maintains the purchasing power of your money. Do not overexpose your investment in Gold, I’d advice not more than 10% allocation to gold (Personal Disclaimer I invest only 6%. Also, don’t buy physical gold, we should but Gold ETF or Gold Sovereign Units)

4. Index ETF (10%)

By definition, an exchange-traded fund (ETF) should just replicate the returns of its respective underlying. For example, an Index ETF like Nifty bee is supposed to mimic the performance of the Nifty 50 index. I think young parents should consider an exposure of at least 10% towards an Index ETF.

The rationale is very simple; an index like Nifty 50 represents the broad Indian economy. If you believe the economy will do good going forward, then naturally the index will also do well. If the index performs well, so will its ETF.

As you may have realized, the portfolio I’ve suggested is skewed towards equity. I personally believe that over the next few years, equity as an asset class will outperform every other asset class in India.

This is not a blind faith, but rather an outcome of a well-structured thought process. Perhaps discussing this thought process, itself will be another article, for another day. If you remember I said above I am happily retired at 43, by investing almost 70% of my savings in equity for last 15 years which gave me annual CAGR of 18%. But in this article, we have assumed only 12%. Imagine the value of portfolio if returns are 18%.Disclaimer: The author is founder of retireby49.com The views and investment tips expressed in this article are of his own and not that of the website or its management. Please talk to professional Financial Planner / Advisor for better financial planning.

While delivering sessions on Financial Planning I always came across common question. What is the difference between buying financial products from agents and advisors? Also, many people show interest in doing planning but when they are asked to pay upfront fees, they are bit hesitant and assume other people / company is providing service for free of cost why should we pay fees to “Advisors”? In this world nothing comes for free; instead someone charge you for service and others make money by indirect ways. To be honest indirect way of fees is too high compared to direct fees. So, I thought why not to write article on this and explain how this both professions make money from clients.

A financial advisor or an agent may sell similar products to you, but they can have different objectives. Agents will be obliged to their company’s profit margin and self-commission more than to client’s financial well-being.

There is a clear distinction between the two professions. Let’s understand who does what:

Both agents and advisors exist in market, but unfortunately, there is very small percentage of the certified “financial advisors” are available who ask for direct fees for financial planning. Fee-only advisors charge only for your financial planning i.e. to YOU. Whereas, financial agents sell products to you for which they get compensation by their employer. Their pay structure isn’t necessarily based on the services to you but more on the financial products they sell to you for a commission.

Sometimes this imbalance is so extreme that you lose money on your investments. Agents plainly took advantage of clients and had been sold several annuities and high commission loaded funds that, even in an up-market, were not returning enough or in some cases the investments are in negative even after 2 -3 years. Please try to understand who is better for your financial goals to be achieved. I urge you to seek out fee-only advisors and not agents.

Here are two PERSPECTIVES and key differences between an Agent v/s Advisor:

Here are few examples of products suggested by Agent vs Advisor:

| Product Name | Agent | Advisor |

| Endowment Insurance Policies | Will try to push those products so hard, for which they get good 30-40%of commission on selling them in first year and 2 to 3.5% commission thereafter till client pays the premium | Will never suggest such products as they are financially not good for client, as these products cannot even beat inflation |

| ULIP | Agent will try to sell ULIP instead of Equity based products like Mutual funds as it provides more commission compared to other equity-based products | Will never suggest such products as there are many other products in similar investment category which can give better returns |

| Equity Mutual Funds | Will always suggest to buy “regular plans” or “NFO” (new fund offer) as they get more commission if they sell Regular plan of mutual funds and NFO products | Always suggest to buy “Direct Plans” only and will never suggest to buy “regular plan” or “NFO” (will suggest NFO only if it is very unique and no similar product is available in the market) |

| Property Insurance | Will recommend to buy insurance for the total cost of flat / house value to earn more commission | Will advise to buy only up to the cost of construction as they are aware land will remain in same condition in all types of risk like Earth quake, tsunami or fire, so insurance for land is not required which can save approx 70% of premium |

| Term Insurance | Will advice to buy offline products to get better service, so that in turn they get good commission | Will advice to buy online Term Insurance directly from the portal of respective Insurance company which can save almost 50% of premium |

Here are few examples how much money we lose if invest based on suggestion of an Agent V/s an Advisor (Assumption is 5000 Rs per Month in below mentioned two products)

| Product Name | Agent | Advisor |

| Endowment Insurance Policies | After 20 years we may get only 17 to 20 Lakhs (based on tax bracket) and Insurance coverage of 10 Lakhs | Will suggest online Term Insurance worth of 50 Lakhs and rest money to be invested in balance funds that will give close to 30 to 35 Lakhs (assuming 10% returns) |

| Mutual Funds | Will suggest Regular plan of Mutual funds (5000 SIP for 25 years will become 1.17 CR (Assuming 15% CAGR)) | Will suggest Direct plan of Mutual funds (5000 SIP for 25 years will become 1.4 CR(Assuming same 15% CAGR)) |

Moral of the story is agent will say I don’t take even single penny from you for the service and he is taking out 40 Lakhs from you indirectly in the form of commission from just 2 products for self & company they are associated with.

Let us assume, an Advisor is taking direct fees from us as up front which is approx. 5K per Annum, still we end up paying only 1.25 Lakhs for 25 years (Even it is inflation adjusted fee which may increase over the years still it will not be more than 3 Lakhs, I hope it is simple to understand with 10K investment might have been by excess of 35 to 40 Lakhs after 25 years if invested based on Advisor’s recommendation)

Note – The above illustration is for only 10K investments per month (5K in Insurance and 5K in Mutual funds). If we plan to save more than 10K per month, then check what potential loss we will have. But, advisor fees will remain same 5K per annum even if our investments increases (Advisor charges are per annum and not per product suggested)

Personal Experience : Do you know most of Financial Planners come to Industry to become good Advisors and help their respective clients in planning. But, when client is not willing to pay direct fees, they are indirectly forced to become agents to fulfil their financial need. Think once, if you want best salary to be paid by your employer, why a financial Advisor cannot expect the same? If we don’t pay directly they will find alternatives to take more from us. Agent who comes to your home / office to collect documents and recommend you best products and don’t charge you. Why? In my case, my agent used to get even chocolates for my son and sweet box on Diwali, which made me think. Now, you think you will have similar experience and ended up buying wrong products.

“Nothing comes for Free of cost. Honesty is very rare quality, don’t expect it from all.”

While sitting idle over the weekend with family, my wife said “bore ho raha hai…kuch kam chahiye dimag ko” and one thought came up in my mind. Why don’t we invest ~ 1/2 hour time to create simple strategy for coming week and decide investment strategy!!

I have already been working on some strategies since 3 months post my retirement that can be used in investing in stock markets. So, I came up with new strategy that can be build over weekend by investing 30 minutes and spend 5 minutes on working days to buy & sell them.

The strategy uses a systematic, non-emotional and simple investing approach using stock strength momentum to help you run your investment portfolio successfully on Indian equity stocks by investing just 30 minutes on weekend.

The thought behind the strategy was the approach should be so simple that a person with no background of equity markets should be able to understand the concept and can identify winning stocks on their own without any hurdle.

I have decided to finalize one of the strategy that I use for my stock selection. So, first I have finalized a list of 100 stocks for screening on every weekend (anytime after Friday 5PM and before Monday Moring 9AM) on which this strategy can be applied.

Next decision was the focus on creating a strategy that should work for those who want to generate regular monthly income or if someone has long time horizon, then also it should help them in creating long term wealth.

The participants have to simply follow the strategy and create a portfolio in their own account. This approach ensures regular income along with wealth creation for you. One needs to devote precisely 30 minutes a week to their portfolio and stock screening every weekend. This portfolio will complement well with your other investments if any in Equity or PMS investments you have and help in monitoring them as well.

Due to the tactical allocation model, the system keeps you safe by shifting money to debt during times of deep distress or you don’t find any buying options with the above strategy (Which is very rare).

Below is graph of Infosys for which system provided Entry point. Our weekend strategy has given a buy call on Dec 17, 2017 around Rs. 1000/-, on 27th Mar it is trading around 1160/- almost 16% returns in 3 months. Most important point to note is during this period market given minus 3 % returns.

Holding period can be as short as one week or it can go as long as 12 months. Stop loss may not hit for one year. But you can exit as per your strategy / need. If it is for long term, continue to hold till stop loss is not hit otherwise book partial profits to generate regular income.

After developing this simple strategy, we thought we will run this with few participants who don’t even understand what is stock market or equity and they have not heard of equities in the past.

Apart from my wife, during summer vacation (CBSE short summer vacation In March), I have explained this to my niece and sister in law. My Niece who is in her teen age was able to understand and trade couple of stocks in last 3 weeks and earned ~3K with very short capital under her mother’s guidance.

Then we have decided to back test this strategy. We have back tested most of the stocks from the 100 stocks we have identified. We have back tested the stocks for last 8 years and it has given average ~24% annualized returns. At the same time this strategy was profitable and generated positive returns on more than 70% trades, if we have followed system without fail.

Below is back tested entry and exit for Maruti Udyog stock, for last 6 years, it has given 300% returnsIf anyone want to earn regular returns / build long term portfolio can use this strategy and we will be happy to help them.

Please feel free to contact us on retireby49@gmail.com or +91 93710 89359.

You can also follow us on

I am available for freelance work. Connect with me via and call in to my account.

Phone: (555) 345 678 90 Email: admin@example.com