About Me

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Eum in eos saepe ipsa cupiditate accusantium voluptatibus quidem nam, reprehenderit, et necessitatibus adipisci labore sit veritatis vero tempore sequi at sed facere dolore. Quae obcaecati eius quasi doloribus illum minus fugit.

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Eum in eos saepe ipsa cupiditate accusantium voluptatibus quidem nam, reprehenderit,

What I Do

Business Stratagy

I throw myself down among the tall grass by the stream as Ilie close to the earth.

Business Stratagy

I throw myself down among the tall grass by the stream as Ilie close to the earth.

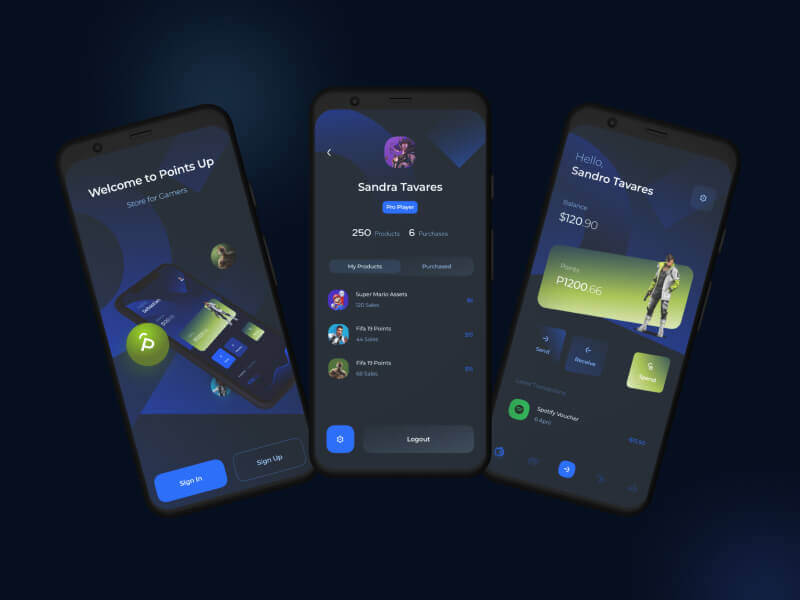

My Best Work

The services provice for Android user

Lorem ipsum dolor sit amet consectetur adipisicing elit. Modi, quidem dignissimos. Perspiciatis fuga soluta officiis eligendi labore, omnis ut velit vitae suscipit alias cumque temporibus.

Responsive design

Quiz builder

Certification

Stats & reports

Retina ready

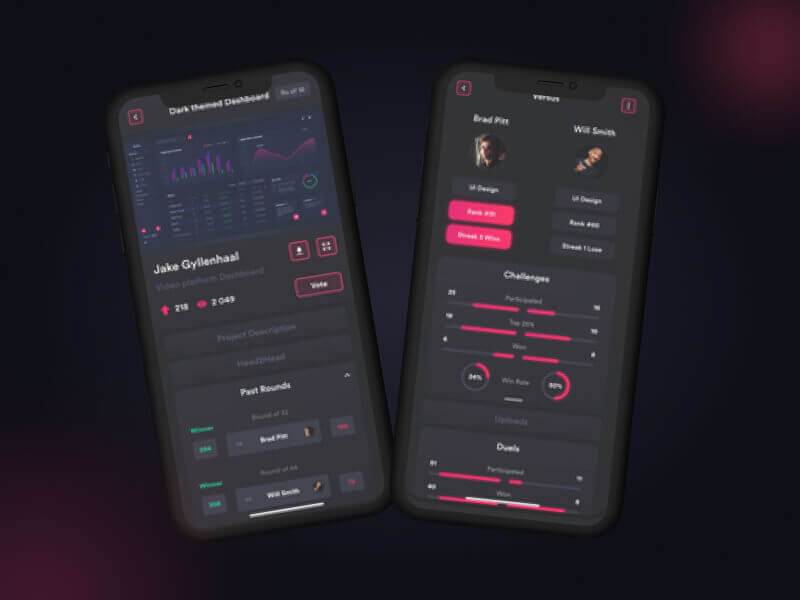

The services provice for Development

Lorem ipsum dolor sit amet consectetur adipisicing elit. Modi, quidem dignissimos. Perspiciatis fuga soluta officiis eligendi labore, omnis ut velit vitae suscipit alias cumque temporibus.

Responsive design

Quiz builder

Certification

Stats & reports

Retina ready

The services provice for Android user

Lorem ipsum dolor sit amet consectetur adipisicing elit. Modi, quidem dignissimos. Perspiciatis fuga soluta officiis eligendi labore, omnis ut velit vitae suscipit alias cumque temporibus.

Responsive design

Quiz builder

Certification

Stats & reports

Retina ready

Testimonial

Amy Smith Engineer

@mr_rasel Ypur plaser well for your template from @mr_faruk There is no is best issueusing it too. It'll really speed up the design and development process :).

Amy Smith Engineer

@mr_rasel Ypur plaser well for your template from @mr_faruk There is no is best issueusing it too. It'll really speed up the design and development process :).

Amy Smith Engineer

@mr_rasel Ypur plaser well for your template from @mr_faruk There is no is best issueusing it too. It'll really speed up the design and development process :).

Amy Smith Engineer

@mr_rasel Ypur plaser well for your template from @mr_faruk There is no is best issueusing it too. It'll really speed up the design and development process :).

Our Pricing

Use the free templates with your whole team or choose a premium. ith your whole team or choose a premium.

Get the bundle and get lifetime support and one year updates.

STARTER

Try and decide.$0

BUNDLE

Try and decide.$60

My Blog

How to maintain “Financial Health” during COVID-19

COVID-19 or Corona Virus making headlines around the world. It’s normal to feel uncertain about many aspects of life right now, including finances.

Let’s take a closer look at how you can keep your finances in order as the COVID-19 situation develops around the world.

Try to Save More

In the current situation, you are staying at home for weeks due to this pandemic. There are chances that you may be losing your regular income during this time if your employer is not offering paid leave or work from home facility is not available. Instead of getting panicked, focus on finding ways to stretch on saving your money. You may be wondering how?

There are few ways of doing so; cutting non-essential spending from your budget. Like, currently you are staying at home, you will be able to save money that you use to spend on transportation and eating outside food. I’m sure your weekend getaways are also locked down currently as you are entertaining yourselves at home through various online media that comes at bare minimum cost. You can consider this money in saving.

Emergency Fund

If your company allowing option of working from home, then consider boosting your emergency fund as you are having your regular income source is still flowing. So, it will be easier to resist the temptation of spending money on impulse buys like online shopping. Take this opportunity to increase your emergency savings (Keep at least 6 months of monthly expenses in Emergency funds).

Stick to Your Investment Plan

Due to COVID-19, there is increased volatility in the stock markets. It is creating anxiousness and in panic, we are tending towards selling our stocks / Equity Mutual Funds during this time of crisis. But believe me, that’s not a good option right now. In fact, choosing to sell your stocks now could result in a realized loss.

I know, it is difficult to watch the value of your portfolio going down and sitting idle of not doing anything to stop it. However, over the period equity markets will recover. Personally, I never planned on touching the money I have invested in the market until retirement. So, I’m not going to change that mindset and stick to the original plan for now. Instead, I plan to hold on for what looks like a wild ride ahead. I fully expect a bumpy ride, but I know that selling stocks for 20 to 30% loss is not the answer. But we can always re-evaluate our investment plan and make any changes if required with the help of Investment / Financial adviser. Important point to note here is don’t stop your SIPs. Instead if possible, increase the amount of SIP.

Take Advantage of Low Interest Rates

As the feeling of uncertainty is around the world, interest rates are dropping as well. If you have a good credit score, then you can likely take advantage of extremely low rates for all kinds of borrowing; especially housing loan.

If you have outstanding debt such as a housing mortgage or education loans, now is the time to refinance. You could potentially save thousands over the course of your loan. Although refinancing can involve quite a bit of paperwork. As you are at home you can easily do this task with comfort.

Moratorium on Loans (Home, Personal, Education, Car….)

Benefits of Home loan Moratorium

- Moratorium will reduce financial stress for those who are facing income uncertainty due to the COVID-19 crisis

- If you avail moratorium, it will be not be considered as default. So, your credit score will not get affected

- Banks will not charge any penalty for availing moratorium

Drawbacks of Home loan Moratorium

- First thing first, the moratorium is not a waiver. You will have to pay the EMIs later. Given that unpaid EMIs will be added to the principal amount, you will be required to pay a higher EMIs starting from July for the remainder of your loan tenure. This will put additional burden on you

- Opting for moratorium will have tax implications as well. The tax reduction which you avail on interest payments will be affected if moratorium is opted

- Deferring 3 to 4 EMIs could extend your loan tenure by 3 to 10 months depends on loan amount and tenure

- The interest payable on the loan will be higher when compared to the current interest amount

The Bottom Line

We are on edge due to the COVID-19 situation, but that doesn’t mean our finances need to suffer. Act to build your emergency fund before the virus impacts your finances. If your finances are already affected due to COVID-19 situation, take immediate steps to mitigate the long-term financial damage.

STAY HOME, STAY SAFE, STAY INVESTED

DISCLAIMER: Please do your homework and take the help of a qualified Financial Adviser before you take any financial decisions

All about investment

All about investment

Is Demonetization Good for Economy ?

The demonetization-driven cash crunch that is playing out in India will create short-term economic pain in the form of the transactional hit created by a hard cash deficit and the structural hit to non-tax paying businesses that would become unviable.

As we move further away from this event, government’s larger crackdown on black money and its resolve to check tax evasion will yield two distinct sets of benefits:

- A lower cost of capital due to huge inflows

- higher in-flows into the financial services sector which will benefit equities in long term

Also, as the informal sector shrinks on the back of a crackdown in the black economy and on the back of the GST implementation, the formal organized sector is likely to gain market share as a ‘formalization effect’ comes into play from the next year onwards.

Trying to describes in greater detail these complex set of effects that demonetization will trigger in the short to long run all are personal view based on various reading and understanding and these level of recall was not done in history so all these could go wrong, I reserve all rights to be wrong

The informal sector accounts for more than 40 percent of India’s GDP and provides employment to close to 80 percent of the labour force. While it is difficult to capture details regarding the profit margins of businesses in the informal sector, it is safe to assume that from the third quarter FY17 to fourth quarter FY19, the share of the informal economy in India could as low as 20%. This shrinkage of the informal sector is likely to result in a short-term adverse effect as the informal sector is no longer able to employ the numbers that it did. However, as the informal sector shrinks, the formal organized sector is likely to gain market share will benefit listed companies. The formal sector accounts for 60 percent of India’s GDP today. Ambit Capital assumes that from FY17 to fourth quarter FY19, the share of the formal economy in India could expand from 60 percent to 80 percent.

Black money will prevent people from parking their savings in physical assets such as gold and real estate. This should boost the flow of savings into the financial system to a significant extent. This in turn should spell a higher influx of flows for financial services providers such as banks, non-banking financial companies (NBFCs)

The most hit will be real estate, land and gold prices in long term, here are some stocks that can benefit in long run, most of them are part of our portfolio already.

| Stock | Current Price | Why it will gain |

| DHFL | 230 | Lot of money will flow it small and mid-segment housing and cost of fund will go down, short term pain |

| NBCC | 225 | This will be the biggest beneficiary, as Govt will build lot of house for poor on Govt land and only PSU in this psace will see lot of orders and can grow order book at 25% CAGR for next 3 years |

| Sun Pharma | 695 | Sun Pharma is trading at very low and it has acquired one more company is Russia and this will help in growth in business |

| ICICI Bank | 255 | It will be biggest beneficiary of Demonetization, low cost of funds and reeducation in Repo Rate on Dec 7 policy |

| Kotak Bank | 750 | Same as Above |

| PFC | 125 | Lot of money was paif by big Defaulters so it will see very good days ahead |

| IL&FS transportation | 90 | This can benefit as Govt will invest into infrastructure and IL&FS will be biggest beneficiary |

| Tata Motor DVR | 290 | It has fallen for multiple reasons like Mistry issue and Demonetization , but in long term there will be very less impact on Land rover and Jaguar sales |

Thumb Rule of Financial planning

Thumb Rule of Financial planning

30 % of your income must be used for monthly living expenses

40% of your income must be used for Liabilities repayments (Housing EMI, Loans etc.)

30% of your income must be SAVED and INVESTED for your retirement.

3-5% of your income must be spared for Social cause

6 months expenses must be available for emergency (should be invested in LIQUID FUND or any safe instruments which can be liquidate in a days time

Buying second house for investment is not advisable

After 45 years of age, not supposed to enter into any BIG LIABILITIES (Higher education of children and wedding of children will happen around 45 to 50 only, so plan now for the same.)

Have joint account @ Bank savings account.

Property must be registered on both Husband and wife name. (As per legal act – after husband first legal heir is wife, after wife it will go to children only)

Regular check on Nominations at all financial instruments. if not nominated, do it now..

Only in insurance policy, Claims payable to Nominee. In other financial instruments legal heirs certificate is must to get back the settlement

Must have 10-15 times of coverage in form of term Insurance to financially secure future of your dependents

Don’t take any financial investment decisions EMOTIONALLY, and also Avoid last minute tax saving investment decisions, plan well in advance..

MEDICLAIM is must (in spite of Group mediclaim coverage given at office) (After retirement there is no mediclaim coverage, after 50-55 years of age, it’s very tough and costly to enter into mediclaim)

For your jewelry LOCKER, Only one lakh is payable by bank, if theft or fire happen at bank. Provided insurance done.

Like same way Government guaranteed only one lakh for your FD also. (Fixed deposits with Banks upto Rs. 1 lakh only are backed by deposit insurance)

Must know all Tax implications. You cannot avoid paying tax. But you can minimize by way of tax planning and investments..

All financial documents must be kept safely and keep family members informed of the same..

Financial investments must be followed through personal financial advisory

Review your portfolio at every six month

These are general suggestions, personal Finance and investment decisions depends upon case to case, please consult your financial planner and read disclaimer below